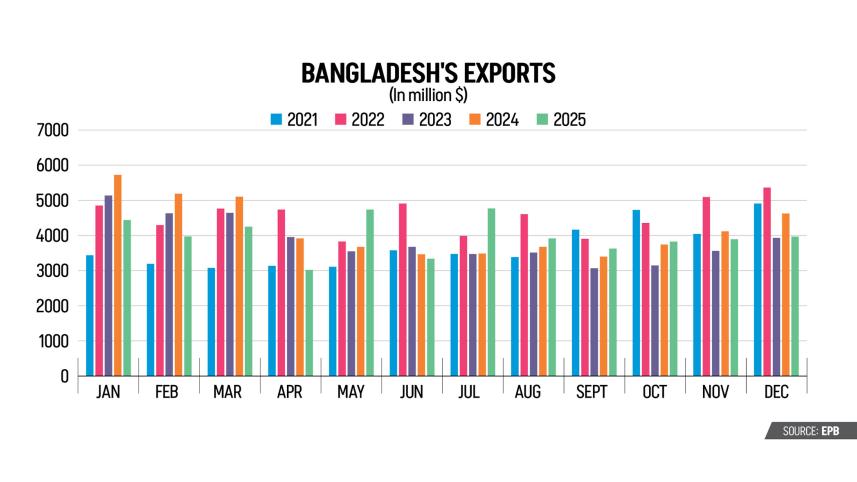

Exports fell nearly 5% in 2025

The country's merchandise exports declined by nearly 5 percent last year, falling to $47.74 billion compared with the previous year, according to official data, as weak global demand for garments and other consumer goods weighed on shipments.

The calendar year closed against a turbulent global backdrop. The prolonged Russia-Ukraine war, Israeli attacks on Palestine and assaults on five other countries heightened tensions across the Middle East, disrupting trade routes and unsettling global supply chains.

These shocks rippled through international commerce and dampened consumer demand in key markets.

Global disruptions hit apparel exports particularly hard. Bangladesh was not alone. Other major exporters in the region, including China, India and Vietnam, also saw their clothing shipments slow as buyers cut orders and trimmed inventories.

Adding to the strain were reciprocal tariffs imposed by the United States, which weighed on exports for much of 2025. Ahead of the finalisation of higher duties, local exporters rushed shipments from April through the first week of August to beat the deadline.

That front-loading came at a cost. Garments, which make up more than 84 percent of the country's export earnings, lost pace during the crucial season for Christmas deliveries in August, September and October.

Retailers in Western markets had already built up inventories, leading to a temporary lull in new orders. The new tariffs also pushed up prices for US consumers, curbing demand and adding further pressure on Bangladeshi exporters.

Even so, manufacturers expect shipments to recover once excess inventories are cleared and demand begins to normalise.

The Trump tariff measures also sharpened competition in major apparel markets. After facing higher duties in the United States, large exporters such as China, India, Pakistan, Vietnam, Thailand, Cambodia, Indonesia and Turkey redirected similar products to other destinations, including the European Union, often at lower prices.

During the July-December period, garment exports fell by 2.63 percent to $19.36 billion compared with the same period in 2024. Knitwear exports dropped 3.22 percent to $10.48 billion, while woven garment shipments declined by 1.91 percent to $8.87 billion.

The slowdown gathered pace in December. That month, garment exports plunged by 14.23 percent to $3.14 billion. Knitwear shipments fell by 13.74 percent to $1.61 billion, while woven exports slid by 14.71 percent to $1.52 billion, according to data released yesterday by the Export Promotion Bureau (EPB).

Despite the sharp overall decline in December, several non-RMG sectors recorded growth compared with November 2025.

Jute and jute goods, specialised textiles, home textiles, frozen and live fish, vegetables, chemical products, rubber, leather and bicycles all posted gains, pointing to progress in export diversification.

Among major destinations, the United States, Germany and the United Kingdom remained the top three markets in December. Exports to these countries grew by 7.14 percent, 18.08 percent and 14.50 percent, respectively.

Shipments to emerging and strategic markets also expanded. Exports to the United Arab Emirates rose by 25.39 percent, Australia by 21.33 percent, and Canada by 9.13 percent. The EPB said the figures showed Bangladesh was gradually widening its global footprint.

In overall terms, merchandise exports in December fell by 14.25 percent year-on-year to $3.96 billion, marking the fifth consecutive month of decline. Compared with November, however, exports edged up by 1.97 percent, offering a tentative sign of month-on-month recovery.

In its monthly report, the EPB said weakening global demand, US tariffs, intensifying competition, rising production costs and ongoing geopolitical uncertainty had created heavy external pressure on export performance.

Domestic challenges also played a role. Industry leaders cited volatile political conditions and limited access to bank financing as key constraints on exporters.

Amid the gloom, there were some brighter notes. Md Abul Hossain, chairman of the Bangladesh Jute Mills Association, said exports of jute and jute goods had risen over the past six months, driven by stronger shipments of value-added products.

Md Shehab Udduza Chowdhury, vice-president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), said demand from the United States weakened as prices rose following the tariffs.

Exports to the European Union, he added, were hurt by lower-priced shipments from competitors such as China, India and Vietnam.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments