Spinners, apparel exporters differ over extra duty on yarn imports

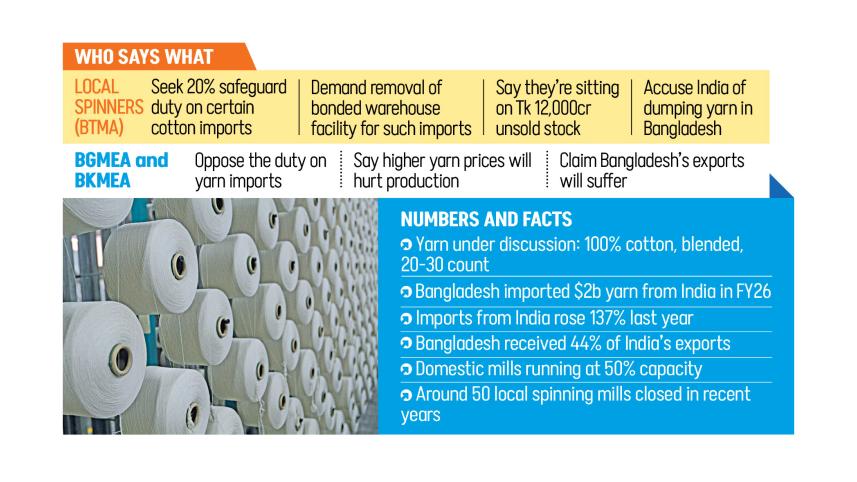

Apparel and knitwear manufacturers have opposed a proposed 20 percent safeguard tariff after local spinners asked the Bangladesh Trade and Tariff Commission to recommend it on imports of 100 percent cotton and blended yarns in the 20-30 count range.

The manufacturers said such a tariff would force them to buy local yarn at higher prices, hurt production, and ultimately affect exports.

Local spinners, however, argued that the safeguard duty is necessary to protect the domestic industry. In the last week of December, they accused India of dumping cheap yarn in Bangladesh and said they were sitting on Tk 12,000 crore of unsold stock.

Domestic spinners claim they can meet the entire national demand for 100 percent cotton and blended yarns, including PC, CVC, PV, and grey melange.

In addition to the tariff, the Bangladesh Textile Mills Association (BTMA) requested the cancellation of the bonded warehouse facility for these yarns, according to multiple sources familiar with the matter.

Against this backdrop, the Bangladesh Trade and Tariff Commission, the statutory body responsible for preventing dumping of foreign goods, convened a meeting with spinners, garment makers and knitwear manufacturers today.

The commission had already held a session earlier this week on the proposed safeguard measure.

The proposal has drawn opposition from the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) and the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA).

In separate letters to the commission, both trade bodies said imposing a 20 percent safeguard duty on yarn imports would put the export-oriented garment sector in serious trouble.

They said the sector will lose its global competitiveness if yarn prices rise as a result of the safeguard duty. They called on the government to improve gas and power supply to industrial units so mills can produce sufficient yarn, and requested incentives to make the domestic mills more competitive.

In the last week of December, Showkat Aziz Russell, president of the BTMA, said at a press conference in Dhaka that local spinning mills were left with Tk 12,000 crore of unsold yarn as cheap imports from India flooded the market.

He said that yarn imports from India rose 137 percent last year, being sold below domestic prices, and that nearly 50 local spinning mills have closed in recent years after failing to survive the competition.

While apparel makers and knitwear manufacturers in their letters said that the government cannot impose such a measure on any particular country under World Trade Organization (WTO) rules, Russell also said the BTMA does not want a 20 percent safeguard duty targeting any single country.

"It is not possible to impose such a tariff on a particular country under the WTO rules," he said. Instead, he called for subsidies on the use of local yarn to make the sector more competitive.

He told The Daily Star yesterday that the amount of stockpiled yarn has decreased somewhat as spinning mills have reduced production due to low demand.

Local spinners are operating at around 50 percent capacity because of low gas pressure, he added.

According to Russell, the total investment in the garment and primary textile sectors is more than $75 billion, including $23 billion in the primary textile sector. Combined, the two sectors contribute $40 billion in exports.

BTMA leaders said Bangladesh imported $2 billion worth of yarn from India in fiscal year 2025-26, with local mills consuming 1,600 tonnes daily. From April to October 2025, imports reached $950 million.

They said Bangladesh has become the largest destination for Indian yarn exports, receiving 44 percent of the total, while Cambodia ranks second at 21 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments