RMG export to India crosses $1 billion

Bangladesh's garment export to India crossed the $1 billion mark for the first time last fiscal year riding on duty free entry and rising demand from a growing middle class.

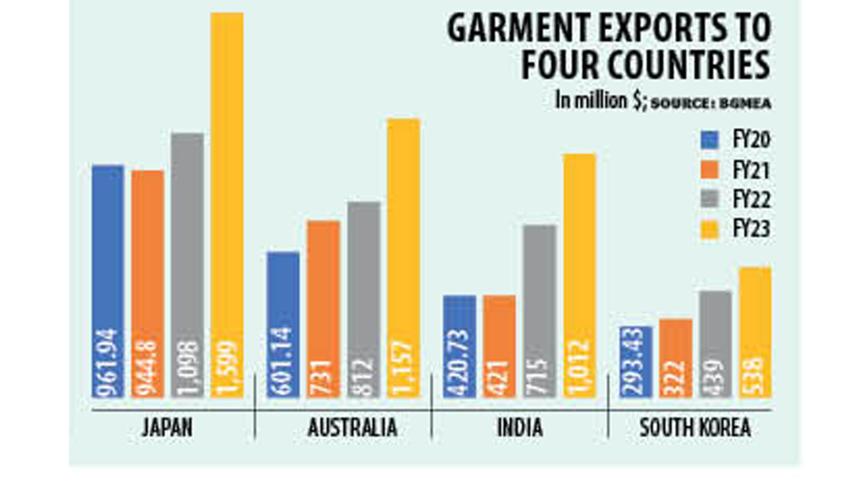

The shipments soared 42 per cent year-on-year to $1,012 million in the July-June period of fiscal year 2022-23, according to data compiled by the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

"It is a promising market and exports to this market are expected to grow," said Md Fazlul Hoque, managing director of Plummy Fashions Ltd, one of the leading knitwear exporters. The green factory also exports to India.

"India is a big market with a growing middle class. And demand from the middle class is rising," he said.

Apparel exports to the neighbouring country was just around $10 million 14 years ago. The earnings crossed the $100 million mark in fiscal year 2014-15.

And in the last three years till the end of fiscal year 2022-23, the exports grew nearly two and half times from $421 million in fiscal year 2020-21 thanks to the duty-free benefit for Bangladesh's products under South Asian Free Trade Area.

There might have been confusion in the past among buyers regarding Bangladesh's products, said Hoque, also a former president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA).

"This has been sorted out for the quality for our products," he said.

There is scope for further growth in export in India, said Mohiuddin Rubel, a director of the BGMEA.

Not only India, garment exports to Australia also crossed the $1 billion-mark last fiscal year which ended in June.

Entrepreneurs sent $1,157 million worth of knitwear and woven garments to Australia in fiscal year 2022-23, registering a 42 per cent year-on-year growth.

"It is another big market. We also have scope to increase export there," he said.

Japan has also emerged as another promising market. Shipments to Japan, the second largest economy in Asia after China, surged 46 per cent year-on-year to $1,599 million in fiscal year 2022-23, according to the BGMEA.

"It is a fast fashion market and people in Japan have the purchasing capacity," said Rubel, also additional managing director of Denim Expert Ltd.

Overall, he said, garment export to non-traditional markets grew 31 per cent year-on-year to $8.37 billion in fiscal year 2022-23.

This led to an increase in the share of garment export to non-traditional markets by around three percentage points to 18 per cent of the total receipts of roughly $47 billion in fiscal year 2022-23.

In contrast, the share of export earnings from traditional markets, which is mainly comprised by the European Union, US and UK, declined as exports growth to the EU slowed while to the US fell.

Rubel said high inflation, overstocking of apparel by buyers and effects of the war in Ukraine were the reasons behind the slowdown in export of garments to traditional markets.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments