Private sector credit growth hits record low

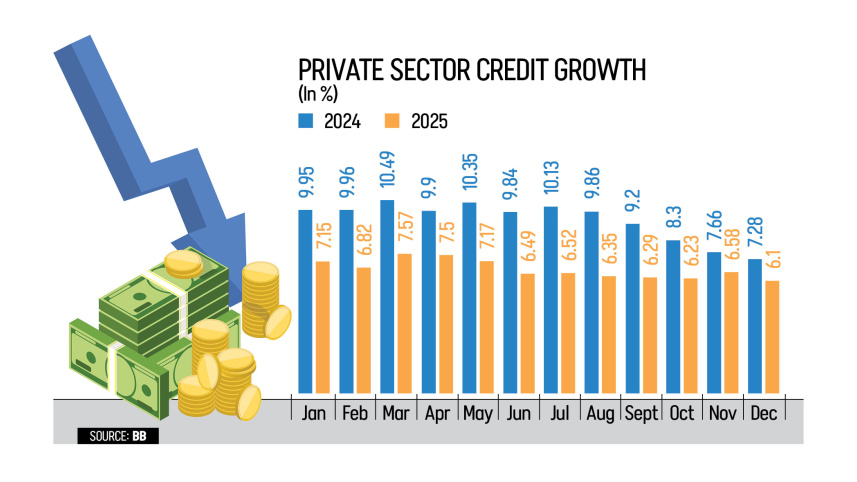

Private sector credit growth fell to a record low in December 2025 due to political uncertainty and an economic slowdown, signalling stagnant investment.

Last month, business credit growth dropped to 6.10 percent, the lowest in at least four years, down from 6.58 percent in November, according to Bangladesh Bank data.

The central bank had set a credit growth target of 7.2 percent for private businesses in December 2025 in its July–December 2025 monetary policy, after growth reached 6.5 percent by the end of June 2025.

Two leading bankers said loan demand remains weak because entrepreneurs are hesitant to make new investments or expand their businesses.

“All are waiting for a peaceful political transition. A free and fair election is needed for credit demand to pick up,” said Mati Ul Hasan, managing director of Mercantile Bank PLC.

He added that the weak loan demand has led to rising liquidity in the banking sector.

Ashikur Rahman, principal economist at the Policy Research Institute (PRI) of Bangladesh, said private credit growth has slowed as economic agents factor in the uncertainty surrounding the national elections scheduled for February 12.

“Since the political climate strongly affects investment decisions, entrepreneurs are delaying investments to see who will take power after the election and whether the process is seen as credible enough to bring political stability,” he added.

Mohammad Ali, managing director and CEO of Pubali Bank PLC, one of the oldest private banks, said private sector investment remains stagnant.

He added that the slow implementation of public development projects is another reason.

“All attention is on the election,” he said, adding that demand for long-term loans and capital machinery may increase in May-June after the election.

Bangladesh Bank said in its July-December 2025 policy that several factors may have slowed credit demand, including weaker borrowing from non-bank deposit corporations and other financial sectors amid ongoing uncertainties in the country, as well as the impact of a contractionary monetary policy.

The International Monetary Fund (IMF) said in its latest report on Bangladesh that unresolved banking issues would further limit credit, reduce investment, and slow growth. High non-performing loans and undercapitalisation in the banking sector restrict banks’ ability to provide credit for private sector development.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments