Ice cream makers pass tough times despite higher sales

Local ice cream producers are going through tough times in spite of logging higher sales in 2021 as they are having to bear higher prices of raw materials amidst the coronavirus pandemic.

The higher prices of raw materials and a lower profit margin have prompted them to decide upon seeking tax benefits from the government.

It is not an isolated incident.

Just a week ago, dairy prices jumped at a global auction, touching a fresh eight-year high, giving further rise to apprehensions for the ice cream makers.

The Global Dairy Trade price index rose 4.1 per cent to 1,455, its highest level since February 2014.

Raw material prices of ice cream climbed in the last three years, especially during the global supply chain disruption during the pandemic, said Shamim Ahmed, chief operating officer of Igloo, the country's top-selling ice cream brand.

"For the surge in raw material prices, our costs soared by around 36 per cent compared to that of 2019," he said.

"We have decided to transfer some burden on to the consumers by raising ice cream price and we would bear some. To mitigate the burden, government support is needed."

Bangladesh is going to turn into a developed nation, so the cold chain industry should become more sustainable but it is a challenging business, he said, adding that the government needs to provide incentives to the sector.

"Moreover, we are urging the government to remove a 5 per cent supplementary duty imposed on ice cream sales," Ahmed added.

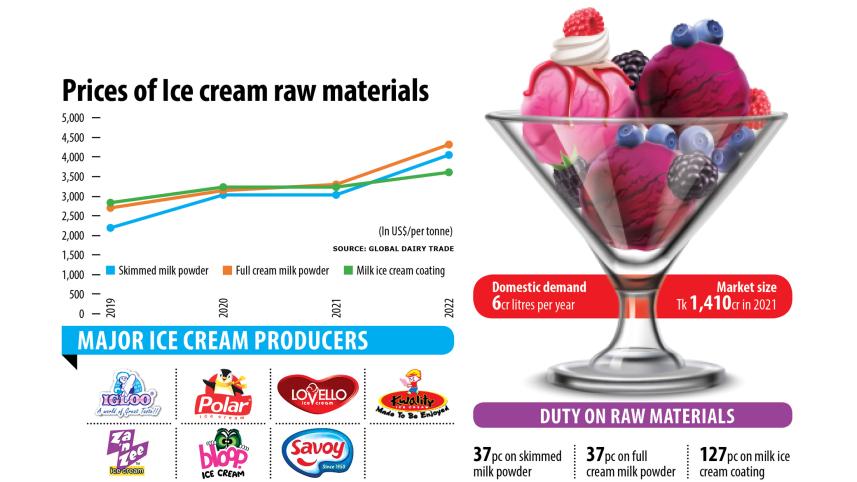

The main raw materials of ice cream are skimmed and full cream milk powder, ice cream coating and sugar.

The price of skimmed milk powder soared 84 per cent to $4,051 per tonne in 2022 compared to that in 2019, according to Global Dairy Trade.

During the same period, the price of full cream milk powder surged 60 per cent to $4,324 per tonne.

Ice cream coating price also rose 27 per cent to $3,600 per tonne, according to Taufika Foods and Lovello Ice-cream Company.

The price of sugar rose 37 per cent to Tk 74 per kg, according to the Trading Corporation of Bangladesh.

Dato' Md Ekramul Haque, managing director of Taufika Foods and Lovello Ice-cream Company, acknowledged the scenario.

The industry faced a serious impact when the pandemic hit due to the rumours that eating ice cream raises the risks of catching the virus, he said.

"Last year, our sales boomed. However, the profit margin fell due to the higher raw material prices," he said.

The sales of ice cream came down to Tk 730 crore in 2020, which was around Tk 1,240 crore in 2019. This was driven by apprehensions of the delicious food turning people more susceptible to being infected with Covid-19.

On the back of awareness campaigns clarifying that consuming sweetened frozen foods does not increase the risk of contracting the virus, sales rose last year to around Tk 1,410 crore in 2021, according to market insiders.

"We can raise the prices of ice cream to adjust the higher prices of raw materials but it might impact our business," Haque said.

"If the government provides a rebate on the import duty of raw materials, we will be able to continue our business. Then, it will be better for consumers and us," he said, adding that the duty was very high.

The government imposed a 5 per cent supplementary duty on sales which producers see as a big amount.

"We will inform the government soon on these. If we can do good business, the government will be able to get higher revenue through VAT and other taxes," Haque added.

Key ingredients needed to produce ice cream come from agricultural commodities and they go through ups and downs, said a top official of Polar Ice Cream.

Some of these ingredients also see unpredictable swings in demand and supply.

"For example, milk prices are running high for quite some time now. We are taking the hit as an unavoidable part of our activities.

However, if this continues, we will not have much choice but to address it as an industry," he said.

Seven brands of ice cream, namely Igloo, Polar, Lovello, Kwality, Za 'n Zee, Bloop and Savoy, are available in the market, catering to a domestic demand of about six crore litres per year.

Igloo is the market leader with a 38 per cent share, followed by Polar with 27 per cent, Lovello with 14 per cent and Kwality with 9 per cent, according to industry players.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments