High NPLs creating risks of credit crunch, stagflation: PRI

The high volume of non-performing loans (NPLs) in Bangladesh's banking sector is creating risks of a credit crunch, weakening investment, collapsing investor confidence, and even stagflation, according to the Policy Research Institute of Bangladesh (PRI).

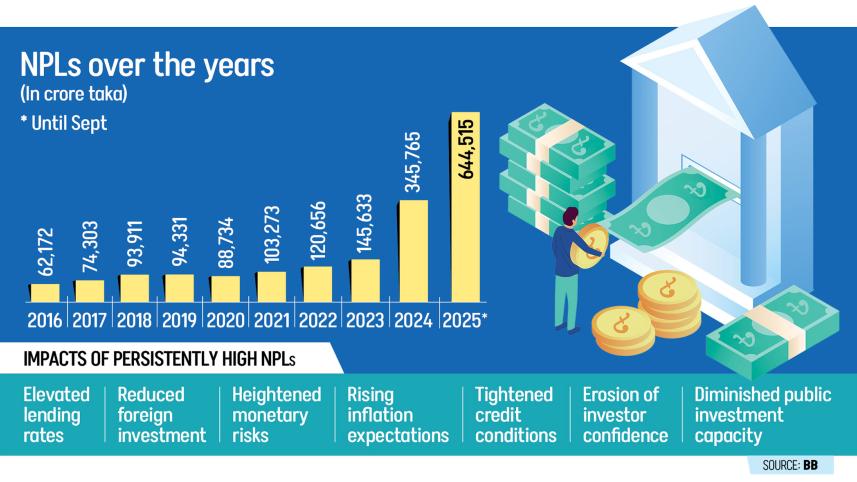

NPLs, loans that borrowers are failing to repay, have reached Tk 6.44 lakh crore, nearly 36 percent of total disbursed loans, according to a PRI study presented at a seminar on its "Monthly Macroeconomic Insights".

"At least 16 banks have become incapable of issuing new loans," Ashikur Rahman, principal economist of PRI, said while presenting the keynote paper at the event jointly organised by the PRI and the Department of Foreign Affairs and Trade of Australia, at the PRI office yesterday.

The paper also noted that distressed assets – the sum of officially classified NPLs along with rescheduled, written-off, and otherwise troubled loans – in the banking sector could now total around Tk 9.5 lakh crore, highlighting the low potential for recovery.

PRI said without decisive action to address rising NPLs, Bangladesh faces mounting financial stability risks.

"Effective NPL resolution will require a comprehensive, multi-pronged strategy – similar to the approaches adopted in the UK, Malaysia, and China – that combines strengthened supervision, robust legal and recovery frameworks, and well-designed asset management mechanism," it added.

A CRISIS NEVER ENCOUNTERED BEFORE

When banks hold so many bad loans, they struggle to lend new money, which slows investment, limits public spending, and undermines economic growth. PRI's study warns that the situation could even lead to stagflation, a scenario in which high inflation coexists with low growth and high unemployment.

Rahman noted that with Tk 6.44 lakh crore in bad loans, reducing interest rates is practically impossible.

He said Bangladesh has yet to develop the institutional capacity to implement international best practices for resolving NPLs, largely because the country has never faced a crisis of this magnitude before.

"But the moment has now arrived when such capacity must be built. Bangladesh has much to learn from how countries like Malaysia, the United Kingdom, and China successfully cleaned up their financial sectors," he said.

The economist added that in many countries, specialised asset management companies (AMCs) purchase NPLs from banks' balance sheets to recover value and restore lending capacity.

If the spiralling bad loans remain unchecked, he warned that Bangladesh risks becoming trapped in a high-interest-rate, high-inflation, low-investment, low-growth equilibrium. "Resolving NPLs is no longer a banking issue-it is a macroeconomic imperative."

Anwar-Ul-Alam Chowdhury Parvez, president of the Bangladesh Chamber of Industries (BCI), said businesses are often blamed for rising defaults, but they are not entirely responsible.

"The business environment here is not supportive. Entrepreneurs now have to take fresh loans just to repay earlier ones," he noted.

Chowdhury also pointed out that the loan repayment period, previously six months, has been reduced to three months, meaning loans are now classified as defaulted much faster, which has contributed to the rise in NPLs.

He recommended improving law and order, resolving the energy crisis, ending mob culture, and providing policy support to businesses. "Otherwise, defaulted loans will continue to rise."

The prominent businessman also stressed the importance of a stable political environment and credible elections for sustainable development.

He further highlighted the need for stronger domestic policy frameworks, a long-term energy strategy, fiscal support, more effective tax administration, banking sector reforms, and comprehensive skill development to build a resilient, competitive economy.

Meanwhile, chairing the event, Zaidi Sattar, chairman of PRI, said the Real Effective Exchange Rate (REER) index - which measures price competitiveness against trading partners – has been rising since May, causing concerns for exporters.

A rising REER signals that Bangladeshi goods are becoming relatively more expensive in global markets.

"The Bangladesh Bank can no longer purchase dollars from the market to depreciate the taka; therefore, loosening import restrictions is the only viable option. This would also benefit exporters," he added.

The central bank has been purchasing dollars from the market to rebuild foreign exchange reserves and maintain stability in the exchange rate in recent months.

Nasiruddin Ahmed, former chairman of the National Board of Revenue (NBR), called for allowing politicians to formulate tax policy and the business community, instead of bureaucrats, some of whom he believes contribute to the problem.

He also highlighted employment and the lack of quality, job-oriented education as major national concerns that the next government must address.

Wasel Bin Shadat, research director at public-private dialogue platform Business Initiative Leading Development (BUILD), raised concerns over fairness in implementing penalties for tax-related violations.

"Compliant taxpayers are being penalised, which goes against the principle of tax justice. This is one of the main reasons why 85 percent of the economy remains informal," he said.

Moreover, he said election manifestos across political parties fail to address the economic situation with sufficient seriousness.

AKM Atiqur Rahman, professor at North South University, said the July uprising led to the disclosure of the true scale of rising NPLs. Otherwise, he said the figures would have remained hidden, raising doubts about the economy's ability to sustain itself.

He emphasised the urgent need for export diversification beyond RMG, warning that potential Trump-era tariffs and a REER above 6 percent are already weakening competitiveness.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments