Foreign loan inflows fall 29% as ADP hits five-year low

Bangladesh received reduced foreign loans in the first half of the current fiscal year (FY) 2025-26 as the execution of foreign-funded projects under the Annual Development Programme (ADP) fell to its lowest level in at least five years.

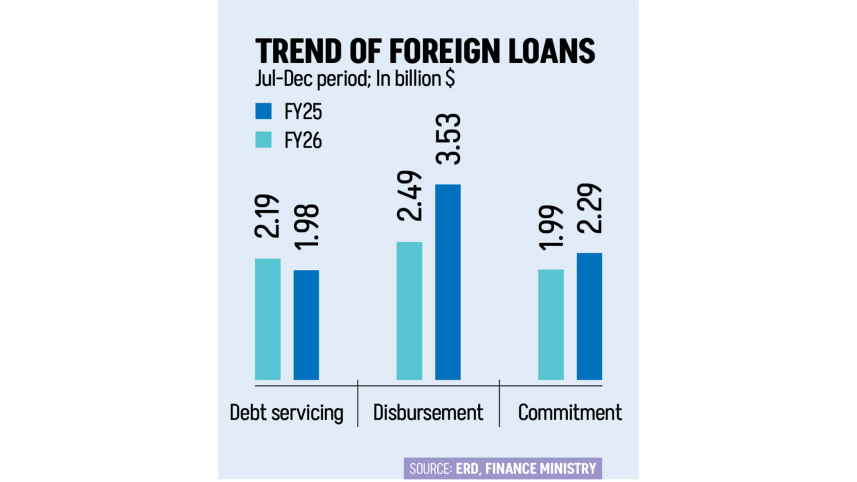

During the July-December period, the country received $2.49 billion from international financial institutions, namely the World Bank and the Asian Development Bank (ADB), as well as bilateral lenders such as Russia, China, Japan, and India.

This represented a 29 percent year-on-year decline in fund releases, according to data from the Economic Relations Division (ERD) of the finance ministry.

During the same period, the implementation of foreign-funded ADP projects stood at 18.58 percent, down from 19.61 percent in the first half of FY2024-25, according to the Implementation Monitoring and Evaluation Division under the planning ministry.

Expenditure on projects tied to foreign loans also fell sharply in absolute terms amid political uncertainty.

Earlier this month, the Centre for Policy Dialogue (CPD) recommended giving top priority to implementing all foreign-funded ADP projects, citing the current state of the country’s foreign exchange reserves.

ERD data showed that commitments of financing from international and bilateral lenders declined as lenders awaited the country’s political transition ahead of the national election scheduled for February 12.

ERD said funding promises fell 13 percent year-on-year to $1.99 billion during July-December of FY2025-26, with the ADB pledging $1.26 billion of the total.

Despite the decline in both commitments and disbursements, pressure to repay foreign loans increased.

Bangladesh’s debt servicing rose 11 percent year-on-year, amounting to $21.9 billion during the same period.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments