Food makers hit by falling profits as raw material prices rise

Profits of listed biscuit makers plunged year-on-year in the last October-December period owing to a rise in raw material prices.

In contrast, milk, juice and fish processors logged higher profits. In the case of ice cream makers and tea companies, profits more than doubled, according to data disclosed by the listed companies.

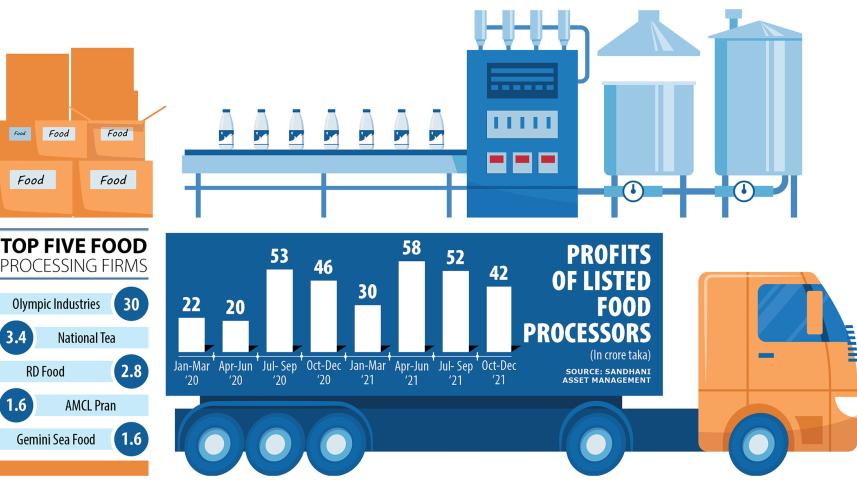

The overall profit of listed food processors dropped 8.6 per cent to Tk 42 crore in the second quarter of the current financial year of 2021-22.

Olympic Industries and Bangas, which own some of the best-selling biscuit brands, showed profit drops of 39 per cent and 78 per cent respectively in the three months.

Higher sales in the period could not offset the increase in raw material prices, showed their financial reports.

"Our main raw materials are flour, coarse flour, oil and sugar, and the prices of all the raw materials rose," said Madad Ali Virani, executive director of Olympic Industries.

Palm oil prices soared around 80 per cent while that of sugar grew by around 30 per cent over the past year.

"We are already trying to adjust the prices of our products but we are cautious as this is a very competitive market," he added.

Although the ice cream industry was also hit by the raw material price hike, an increase in sales saved the day.

"Our sales plummeted in 2020 owing to some rumours regarding the risks of consuming ice cream amid the Covid-19 pandemic but this year, we offered discounts and people are well aware of the safety, so sales rose," said Ekramul Haque, managing director of Taufika Foods and Lovello Ice-Cream.

Profits of the listed company rose 83 per cent to Tk 1.27 crore.

In spite of huge sales in the recent period, the company's profit was not that high due to the price hike of raw materials, he said, adding that the prices of two key ingredients -- powdered milk and chocolate -- had gone up.

However, profits in the October-December period are always low for ice cream producers due to the coming of winter, which is a dull period for sales, Haque added.

Golden Harvest, another ice cream producer, returned to a profit of Tk 64 lakh. A year earlier, the company had incurred losses of Tk 6 crore.

Among those who were able to rake in higher profits are: National Tea Company, Rangpur Dairy and Food Products, the Agricultural Marketing Company (Pran), Gemini Sea Food, Apex Foods, Beach Hatchery and Fine Foods.

Shakil Rizvi, a director of National Tea, said the company was drowning in losses in 2020 due to the pandemic.

But it bounced back this year as demand rose, he said, adding that the price of tea did not rise. In the first half of the current financial year, tea prices were faring well but now it has dropped again, he added.

Cigarette maker British American Tobacco Bangladesh was excluded from this analysis of the food industry.

Zeal Bangla Sugar Mills and Shyampur Sugar Mills were also excluded as the two state-run companies have been incurring losses for many years.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments