Exports hold steady in January

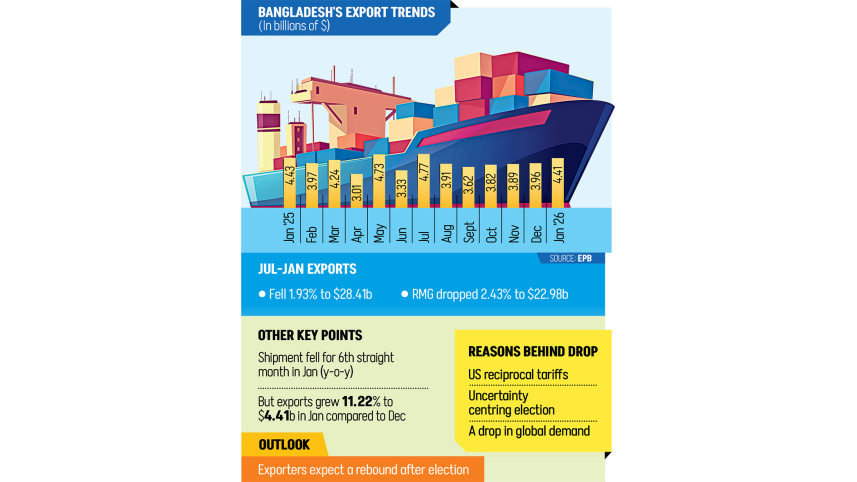

The country’s merchandise exports held nearly steady in January, with shipments totalling $4.41 billion, down 0.50 percent year-on-year, according to Export Promotion Bureau (EPB) data.

A slow recovery in the global supply chain and cautious order placement by international clothing retailers ahead of the general election weighed on growth.

This was the sixth consecutive month exports remained on a downward trend, according to EPB. On a month-on-month basis, however, January shipments rose 11.22 percent from $3.96 billion in December.

During the first seven months of the current fiscal year, exports declined 1.93 percent to $28.41 billion compared with the same period last year.

During the July-January period of FY26, garment shipments, the key point of the country’s trading might, fell 2.43 percent to $22.98 billion. Knitwear exports dropped 3.13 percent to $12.28 billion, while woven garment shipments fell 1.60 percent to $10.69 billion.

Inamul Haq Khan, senior vice-president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), expressed hope for a rebound after the country’s general election on February 12.

“Because the international clothing retailers and brands did not place their full work orders considering the election year, it is a normal practice by the international retailers and brands usually before the election,” he said.

“We are hopeful that a positive change in placing of work orders by the retailers and brands after the election,” Khan told The Daily Star over phone yesterday.

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said exports are expected to pick up strongly from June this year as retailers and brands begin placing orders after February.

Exporters say merchandise shipments from most major countries fell in recent months due to volatility in the global supply chain triggered by US President Trump’s reciprocal tariffs on multiple nations.

The supply chain has been gradually stabilising as the tariffs have been fixed and implemented.

Performance among the top six export sectors outside garments, such as leather and leather goods, jute and jute products, agro and agro-processed items, home textiles, light engineering, and frozen fish, showed mixed results, EPB said.

Leather and leather goods, jute and jute products, home textiles, plastics, and light engineering recorded growth both year-on-year and month-on-month.

Among key destinations, the United States remained Bangladesh’s top export market, with shipments worth $5.24 billion in July-January. Exports to the US rose 1.64 percent over the same period, 3.59 percent year-on-year, and 2.24 percent month-on-month.

Exports to other leading markets, including the European Union, also showed positive trends.

Germany and the United Kingdom retained second and third positions, with earnings of $2.85 billion and $2.7 billion respectively.

Great Britain, Spain, and the Netherlands also recorded growth both year-on-year and month-on-month.

During the July-January period, frozen food exports rose 4.94 percent to $297.56 million, while home textile shipments grew 3.26 percent to $509.97 million.

Jute and jute goods exports increased 1.97 percent to $493.85 million, and leather and leather goods exports rose 5.71 percent to $707.24 million.

Ceramics exports fell 20.91 percent to $17.63 million, and non-leather footwear shipments declined 2.06 percent to $311.53 million.

Cotton products also saw a drop, falling 17.28 percent to $305.57 million over the same period, EPB data showed.

Md Abul Hossain, chairman of the Bangladesh Jute Mills Association (BJMA), said the jute sector had been performing well because local millers can export more finished goods than raw jute.

“The value of finished goods is higher than raw jute, and the rate of value addition is also higher,” he said.

Hossain urged the government to continue the ban on raw jute exports, which was imposed in September last year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments