Engineering posts highest turnover

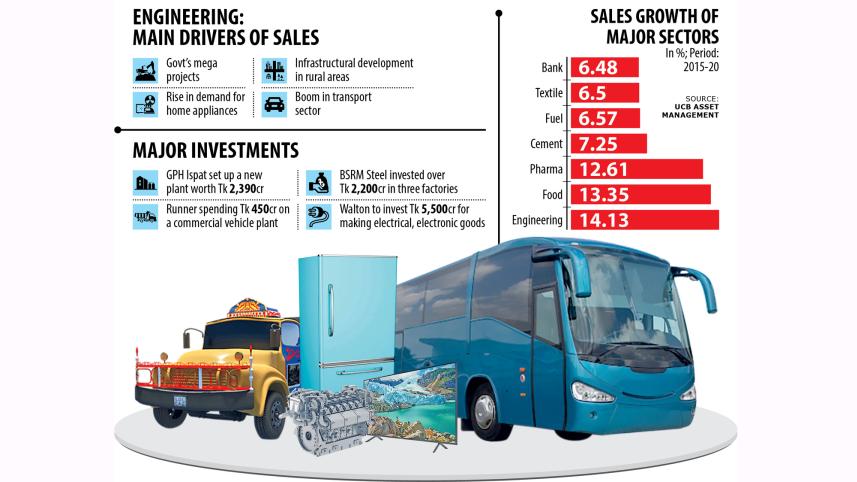

Turnover of the engineering sector in Bangladesh grew at the fastest pace from 2015 to 2020 among all the sectors, reflecting the largely agrarian economy's transformation towards manufacturing.

The engineering sector of the Dhaka Stock Exchange (DSE) represents steelmakers, home appliance producers, automobile companies, and other manufacturing companies, and their sales climbed at the sharpest pace during the period among the 22 sectors used to divide the listed companies into groups.

The turnover of the engineering sector rose at 14.1 per cent on average in the five-year period. The food and allied sector saw a growth of 13.35 per cent, the second-highest, according to the data compiled by UCB Asset Management.

On average, the profit growth in the engineering sector was 3.28 per cent.

The most sales growth among the engineering companies came from steel and home appliance manufacturers.

"As per capita income of people rose, they now demand more home appliances. So, the sales growth is higher in the sector," said SM Ashraful Alam, a director of Walton Hi-tech Industries, the largest home appliance manufacturer in Bangladesh.

Companies like Walton are making products locally that are allowing Bangladesh to cut its long reliance on imports for home appliances, such as air conditioners, dishwashers, clothes dryers, freezers, refrigerators, stoves, water heaters, washing machines, and microwave ovens.

"Many products in our sector were import-based in the past. Now, these products are manufactured in Bangladesh. This transformation has pushed up the sales growth and helped the country save foreign currencies," said Alam.

He said local manufacturers are churning out high-quality products that are available at the prices lower than the imported ones. As a result, even lower-income groups can afford them.

A steady flow of remittance from migrant workers have pulled their families out of poverty and improved their economic conditions. Their living standard has improved, so they are using more home appliances.

"If you visit a remote area, you will find TV or refrigerator in many houses. This speaks volumes about the higher demand in the sector," Alam added.

The government is implementing many infrastructure projects, so the demand for construction-related products has surged in the last decade, said Kamrul Islam, executive director for finance and business development at GPH Ispat, a steel manufacturer.

The mega and infrastructure projects have increased money flow to the rural areas. So, the demand has gone up at the individual level as well.

Rising purchasing capacity and the steady flow of remittance have encouraged people to build a good house, driving up the demand for steel products.

Islam expects the demand growth of steel products to continue to rise in the coming years as many mega projects are in pipeline while the implementation of a number of large infrastructure projects are still underway.

The pharmaceutical sector clocked an annual turnover growth of 12.6 per cent from 2015 to 2020 while it rose 7.25 per cent in the cement sector. The sales of the fuel and textile sectors rose 6.57 and 6.5 per cent, respectively, UCB data showed.

Riding on the higher sales growth, entrepreneurs are increasingly going for new investments.

GPH Ispat set up a new plant by investing Tk 2,390 crore during the period, according to DSE data.

BSRM Steel, the largest steel manufacturers in Bangladesh, invested more than Tk 2,200 crore in its wire, melting, and low relaxation pre-stressed steel strand manufacturing factories.

Runner Automobiles announced to invest around Tk 450 crore in its commercial vehicle plant.

Walton Hi-Tech Industries Ltd is going to make a fresh investment of around Tk 5,500 crore as it looks to expand facilities to produce and increase export of electrical and electronic goods.

Aftab Automobiles and other engineering companies are also making investments to expand their footprint.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments