Economy stabilising but risks remain

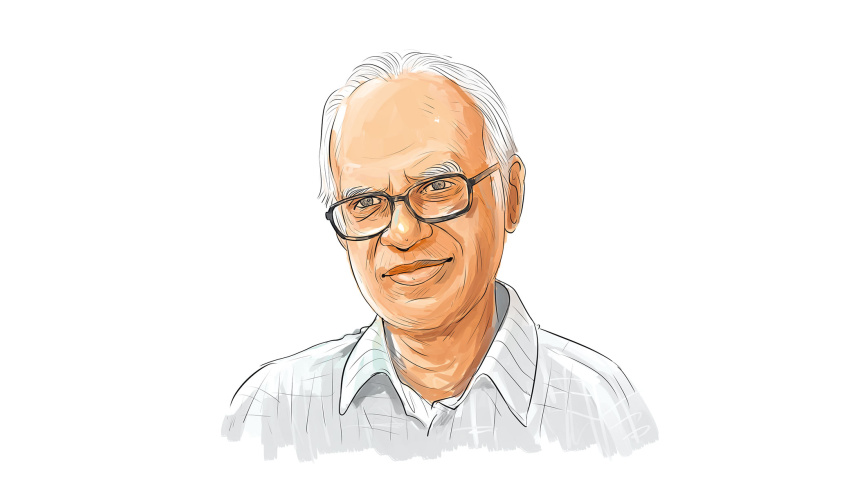

Bangladesh’s economy is showing signs of stabilisation, yet risks and uncertainties remain, and long-term challenges require urgent attention, Planning Adviser Wahiduddin Mahmud has cautioned.

“Inflation, while easing slowly from 11 percent to around 8 percent, is unlikely to drop quickly due to continued high price expectations. Wages are adjusting to inflation, showing the economy has moved into a new phase,” he said, speaking at a seminar yesterday.

Titled “Economic Stability and the Challenges of the Next Government”, the seminar was organised by the Economic Reporters’ Forum (ERF) at the National Life Insurance Auditorium in Dhaka. The ERF Scholarship Award 2026 ceremony was also held.

“GDP growth may reach 5 percent this fiscal year, but I don’t see it as the most reliable indicator. Other markers like imports of industrial raw materials, capital machinery, exports, reserves, and exchange rate give a clearer picture,” the adviser added.

On monetary policy, he noted that the current 10 percent policy interest rate may be unnecessarily high as credit growth remains weak. “SMEs are struggling while RMG exporters are benefiting from a favourable exchange rate,” he added.

Mahmud criticised the hidden costs of stabilisation, including bank recapitalisation using printed money, calling them “invisible but long-lasting consequences” of previous economic mismanagement.

On governance, he remarked, “This is an exceptional government -- neither fully political nor an NGO model. It came out of a mass uprising and is trying to uphold constitutionalism. We’ve never seen this kind of government before.”

He stressed that without major investment in education and skills, the country risks wasting its demographic dividend. He also highlighted progress in public procurement reforms and solar power integration, but cautioned that corruption and inefficiency must be addressed for reforms to succeed.

Azam J Chowdhury, chairman of East Coast Group, stressed the need for broader engagement in economic policymaking, including participation from all political parties and the private sector, to ensure future macroeconomic stability in Bangladesh.

He said discussions around macroeconomic challenges should involve political leaders from across the spectrum. “They must be aware of the current state of the economy and what challenges await in the future,” he noted.

The businessman pointed out that while Bangladesh has adopted some of the IMF’s recommendations, key structural reforms remain pending.

He highlighted inefficiencies and harassment in the business environment. “Even after paying taxes and submitting documents, importers face delays due to unnecessary bureaucracy and interference. These are micro-level operational issues that need urgent simplification,” he urged.

On the energy crisis, Chowdhury said, “There’s no LNG, no LPG, no infrastructure. The interim government has not engaged with the private sector or given clear policy directions. When the next government takes power, how will it manage this?”

Tofazzal Hossain, Chairman of NLICL, called for ethical reform and integrity in Bangladesh’s financial sector, warning against politically motivated bank licensing and poor governance.

Shamsul Haque Zahid, editor of The Financial Express, said the interim government inherited a fragile, near-collapsing economy which it managed to stabilise -- but true recovery remains distant.

He pointed to persistent high inflation, low private investment, and weak job creation, and cautioned that the next elected government will face these issues as legacy burdens.

“The new government may struggle in its first two to three years before achieving stability and growth,” Zahid estimated.

Daulat Akhter Mala, president of ERF, chaired the event, and Abul Kashem, general secretary of ERF, moderated the event. Among others, Syed Abdul Monem, acting managing director of BRAC Bank, and M Kamal Uddin Jasim, additional managing director (AMD) of Islami Bank Bangladesh PLC, also spoke at the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments