Credit card growth: Built on supermarkets, serving a meagre bracket

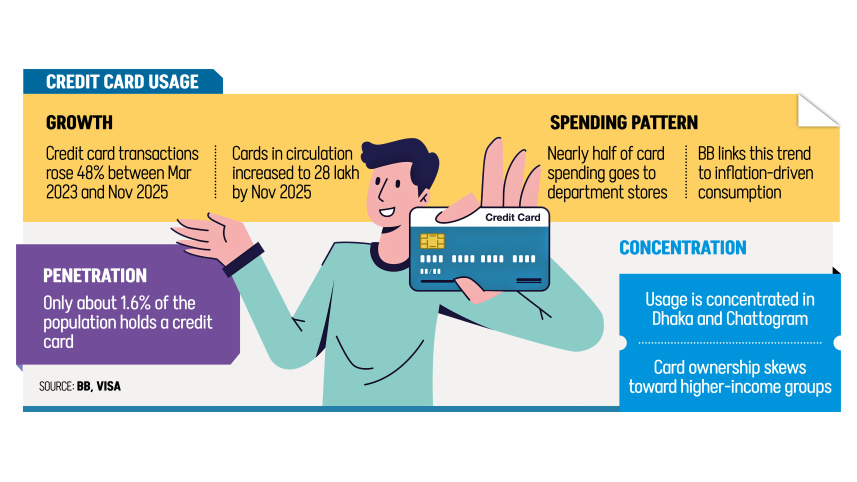

Bangladesh’s credit card infrastructure appears to be thriving, as data from Bangladesh Bank (BB) reports show a 48 percent increase in monthly domestic transaction value between March 2023 and November 2025. Meanwhile, card issuance expanded from 16.39 lakh in September 2020 to nearly 28 lakh by November 2025.

The central bank has repeatedly cited this expansion as evidence of steady progress toward a cashless economy. The growth is real. What is questionable is its depth and durability.

Rather than a diversified digital payment ecosystem, Bangladesh has built a credit card economy overwhelmingly anchored to department stores, an architecture marked by concentration risk, volatility, and shallow penetration.

Department stores captured nearly half of all domestic credit card spending each month from March 2023 through November 2025. In July 2025, their share reached 48.9 percent, meaning nearly half of all money spent by credit cards flowed to large retail chains such as Shwapno, Meena Bazar, Unimart, etc.

Card networks acknowledge that such category concentration is not unusual in emerging markets. Visa notes that in economies like Bangladesh, India, and Sri Lanka, the largest credit card purchases are made in merchant categories such as food and grocery, fuel, insurance, discount stores and retail goods.

“In advanced economies, by contrast, card usage is spread more broadly across services. In the United States, for example, major categories include restaurants, hotels and apparel retail, reflecting a wider integration of cards into daily economic life,” said Sabbir Ahmed, country manager for Bangladesh at Visa.

BB has attributed department store dominance to inflation-driven essential spending, aggressive promotional campaigns by banks and the convenience of organised retail. These explanations hold.

Inflation hovering near double digits has pushed households toward retailers offering card-linked discounts. These benefits are largely absent in traditional markets. Banks, meanwhile, have concentrated incentives where transaction volumes are easiest to scale.

But the concentration comes at a cost. The fragility of this structure was exposed during the political turmoil of mid-2024. Between March and August that year, when a mass uprising ousted the Awami League government, domestic card spending fell 22 percent, dropping from Tk 2,987 crore to Tk 2,332 crore.

Spending rebounded quickly, reaching Tk 3,215 crore crore by December 2024. Yet the recovery deepened, rather than reduced, the system’s dependence on department stores. Their share ranged between 47 percent and 50 percent during the period, as households consolidated spending at large chains perceived as safer and more reliable.

While department stores provide short-term resilience in moments of shock, the entire card ecosystem hinges on the fortunes of a handful of retailers.

Mature payment systems typically stabilise as usage broadens. Bangladesh’s card economy has moved in the opposite direction, suggesting expansion without institutional depth.

Penetration data further undercut the narrative of widespread adoption. Of the 5.28 crore cards in circulation, only about 28 lakh are credit cards, implying a penetration rate of roughly 1.6 percent in a population of about 17.5 crore.

Visa, which processes over two-thirds of card transactions in Bangladesh, acknowledges that credit card usage remains skewed toward higher-income and higher-middle-income groups.

“In recent days, however, increasingly we are observing that credit card usage is becoming more popular among the middle-income segment," Ahmed said, adding that this is true especially among young professionals, because of interest-free periods and various offers promoted by banks.

Credit card issuance growth -- only about 75 percent over five years -- indicates saturation within a narrow user base. Geography reinforces the same pattern.

“Card usage is much higher in Dhaka and Chattogram compared to the rest of the country. However, we have been observing increased contribution from other areas as well,” said Ahmed.

He added that Visa observed good growth in domestic spending through credit cards in Bangladesh during the past few months.

Cross-border spending witnessed subdued growth. In November 2025, Bangladeshi cardholders spent about Tk 511 crore abroad, up from Tk 426 crore in March 2023. VISA attributes the trend partly to visa-related and corridor-specific constraints.

“Cross-border spending growth rate has been muted due to multiple reasons, including visa-related challenges in different corridors. We are hopeful that after the election, issues hindering card usage, particularly in cross-border, will be resolved and there will be encouraging growth in card usage,” he said.

Structural barriers at home remain largely unaddressed. Small retailers resist card acceptance because of merchant discount rates. Traditional markets lack terminals and connectivity. Many service providers continue to operate on a cash-only basis. Until card spending spreads across transport, healthcare, education, utilities and informal retail sectors, credit cards will remain niche instruments rather than foundations of a cashless economy.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments