Abolish minimum tax, wealth surcharges

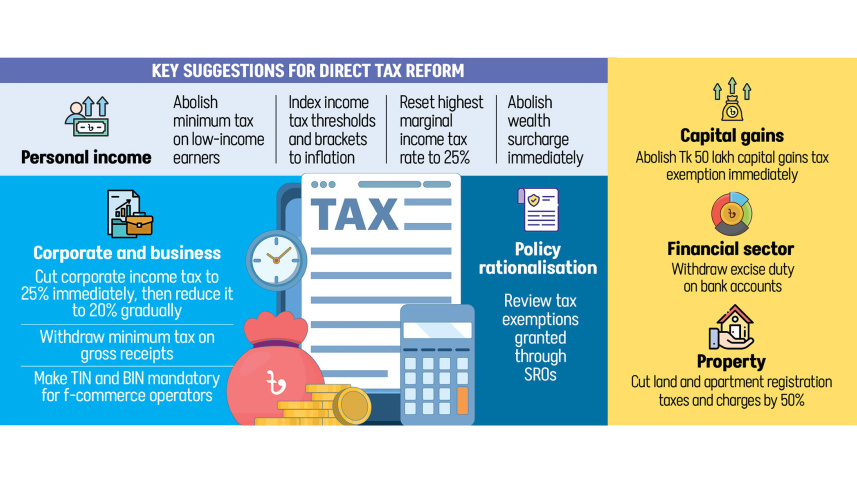

A national tax reform taskforce has recommended abolishing minimum taxes and removing wealth surcharges, saying that minimum taxes on firms are calculated on gross receipts and do not take profit or loss into account.

Meanwhile, the maximum 35 percent wealth surcharge had encouraged avoidance rather than voluntary compliance, said the 11-member panel, led by Zaidi Sattar, chairman of the Policy Research Institute of Bangladesh (PRI).

In a report submitted to Chief Adviser Prof Muhammad Yunus on Tuesday, the taskforce also called for scrapping excise duties on bank accounts, saying such charges discourage households and businesses from using the formal banking system.

It suggested introducing income tax thresholds adjusted for inflation to simplify the system further.

The taskforce, formed by the interim government in October last year to address the country’s poor tax-to-GDP ratio, proposed raising direct taxes to account for half of total tax revenue.

The proposals are part of a wider effort to streamline the tax structure and reduce its reliance on indirect and presumptive taxes, as the country faces pressure to expand revenue ahead of its graduation from least developed country status.

The report, titled “Tax Policy for Development: A Reform Agenda for Restructuring the Tax System”, described the country’s tax system as “unnecessarily complex, inefficient, and excessively dependent on indirect taxes”.

The report’s central message is to simplify the tax system and reduce the burden on people, which it says would increase collection.

Bangladesh’s current tax framework faces multiple limitations. The report identifies 30 policy issues and recommends fundamental reforms to direct taxes to support long-term economic growth.

It highlights seven priority issues, suggesting short and long-term measures to raise the country’s revenue-to-GDP ratio from 10 percent to 12 percent by 2030, and 15-20 percent by 2035.

Currently, minimum taxes on gross receipts range from 1 percent to 3 percent, and businesses have long demanded their removal. “To restore fairness and focus on taxing net income,” the taskforce said the provision should be scrapped.

It also proposed an indexation system, using the previous year’s consumer price index, to automatically adjust thresholds and tax brackets each year. At the same time, the first bracket would be taxed at 10 percent rather than the current 5 percent.

On digital commerce, the panel recommended a regulatory framework requiring tax identification and business registration numbers for f-commerce operators. The report said the sector, which has grown rapidly with online retail, remains largely informal, limiting oversight.

For corporate tax, the panel suggested setting the highest marginal rate at 25 percent and gradually reducing it to 20 percent.

It also called for a review of tax exemptions granted through statutory regulatory orders, saying that discretionary incentives had narrowed the tax base and created unequal conditions across sectors.

In a shift from recent policy, the taskforce proposed halving registration taxes and fees on land and apartments to curb under-declaration of property values and revive sluggish real estate activity.

“High taxes and charges during land or apartment registration encourage undervaluation,” the report said.

The panel recommended abolishing the wealth surcharge and removing the Tk 50 lakh capital gains tax exemption, arguing that high headline rates and complex compliance requirements had encouraged avoidance rather than voluntary participation.

It also called for dropping the requirement for taxpayers to reconcile declared wealth with lifestyle expenditures, which the report said added administrative complexity without significantly boosting revenue.

It also advocated for a comprehensive re-evaluation of tax exemptions granted to firms through statutory regulatory orders (SROs), arguing that many incentives lack transparency, are weakly monitored, and often fail to deliver the intended investment or employment outcomes.

Zaidi Sattar said, “Over the last decade, our revenue collection methods have become extremely complex. It is difficult to expand the scope of revenue collection without reforming these processes.”

“If these are reformed quickly, it will have a far-reaching positive impact on the economy,” he added.

Finance Adviser Salehuddin Ahmed said the report would serve as a guideline.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments