Garment exports to US grew 15% in Jan-Oct

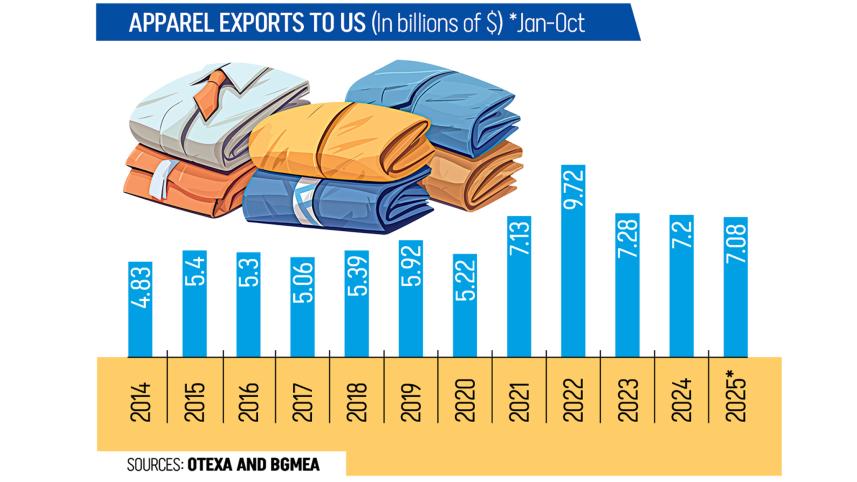

Bangladesh’s readymade garment exports to the United States, the country’s largest single-market destination, grew more than 15 percent year-on-year to $7.08 billion in the January-October period, according to US government data.

Local apparel makers say the surge was largely driven by front-loaded shipments ahead of the Trump administration’s reciprocal tariff enforcement.

A temporary 10 percent baseline tariff was applied by the US from part of April to the entire July before higher country-specific rates took effect on August 7 last year. It added with the existing 16 percent, taking the total rate to around 26 percent.

During the low baseline tariff period, local apparel makers say American buyers brought in larger-than-usual consignments. Apparel exporters said this rush pushed overall shipments in the January-October window above normal levels, somewhat masking the basic trend for the rest of the year.

For Bangladesh, a punishing 35 percent reciprocal rate was initially announced in April last year. It was later revised to 20 percent after bilateral negotiations.

The growth came amid a largely flat US apparel market. Total imports from the world by the United States declined 0.61 percent year-on-year to $66.63 billion during the January-October period last year, according to the Office of Textiles and Apparel (OTEXA), an agency under the US Department of Commerce.

Similar to Bangladesh, most other major exporting countries also saw positive growth in the American market during the period.

Vietnam’s exports to the US rose 11.5 percent to $14.16 billion, India’s 8.6 percent to $4.39 billion, Pakistan’s 12.3 percent to $2.02 billion, Indonesia’s 10.1 percent to $3.98 billion, and Cambodia’s 25.5 percent to $4.04 billion.

China was the exception, with exports to the US falling 32.4 percent to $9.49 billion.

During the period, unit prices of Bangladeshi garments declined slightly, reflecting intense competition and cautious buying by US retailers, according to OTEXA data.

The unit price for Bangladeshi items declined 0.63 percent. The decline for Vietnam was 0.46 percent and 10.47 percent for China. Cambodia’s price declined by 7.26 percent, Pakistan’s 6.85 percent and Indonesia’s 2.72 percent, show OTEXA data.

In the case of India, the unit price increased by 1.57 percent during January-October.

Despite the strong headline growth, exporters said momentum began to ease after August. Shipments weakened in October and November, following the enforcement of the higher tariffs.

Anwar-ul Alam Chowdhury (Parvez), former president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), said the January-October figures do not fully reflect the year’s underlying trend.

“The growth was concentrated in the early months, when shipments were rushed ahead of tariff enforcement,” he said.

Parvez added that export performance slowed after August but expects shipments to stabilise after Bangladesh’s general election next month, as international buyers are likely to place full work orders once the heated political atmosphere cools off.

Meanwhile, retail sales in the United States posted solid year-on-year growth in November, with early holiday-season activity keeping results on track to meet the National Retail Federation’s (NRF) 2025 spending forecast, the organisation said in a statement recently.

It means the retail buying is likely to consume the fashion inventory, prompting the US buyers to place fresh orders.

“Retail sales showed healthy year-over-year gains in November, while month-on-month data was largely flat,” NRF President and CEO Matthew Shay said.

For large apparel manufacturers like Bangladesh, it is positive news on the export front.

Shay said, “Shoppers looking for online deals may have held back a bit until Cyber Monday, which fell in December this year due to a late Thanksgiving, likely shifting some spending. Consumers are focusing on value and spending carefully during the holiday period, and retailers are offering products at competitive prices to fit every budget.”

“We remain confident in our holiday forecast as well as our retail sales projections for the full year,” he concluded.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments