Exports crash to a 40-year-low

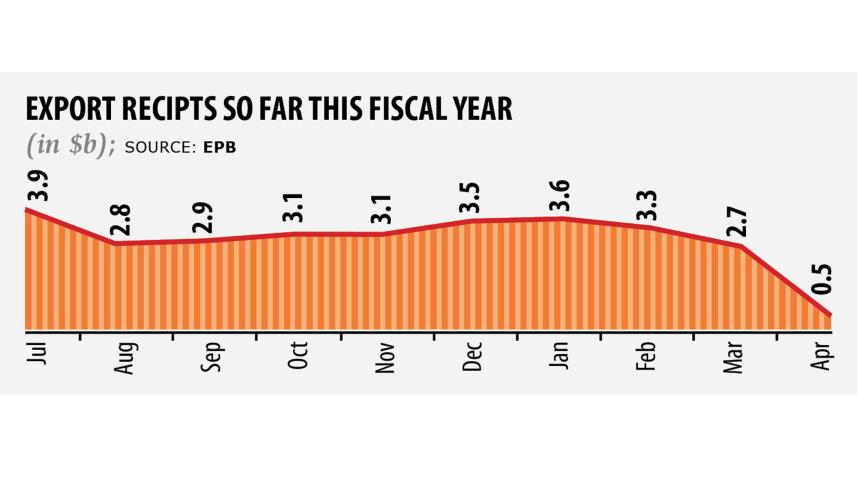

Incredulous, is what one would sigh when chancing upon April's export receipts, which hit rock-bottom at $520.01 million.

The earnings nosedived five times from the previous month and 82.9 percent from a year earlier, according to data from the Export Promotion Bureau -- in what is the clearest harbinger of Bangladesh's export prospects in the near future as the rogue virus continues to ram the global economy towards its worst recession since the Great Depression.

Garment, which brings home as much as 84 percent of the export earnings, fetched just $378.40 million, down from $2.26 billion in March.

As the dust settles, April's export performance might not seem so shocking seeing that the country has been on a general shutdown since March 26, with factories shut and port activities pared down to the bare minimum.

And most importantly, the countries where the shipments are headed mostly -- the US and the EU -- have been on lockdown since February to flatten the curve on coronavirus, which has so far infected upwards of 3.9 million people around the globe and claimed more than 271,000 lives.

Much of the Western world is still grappling with the lethal pathogen three months on and debating when to bring their economies out of the induced coma.

In the meantime, millions are losing jobs. For instance, US unemployment hit a post-war high of 14.7 percent in April as 20.5 million lost jobs during the course of the month.

And in the EU, where the unemployment rate is not so bad, its economies are heading towards their worst recession ever.

Europe's economy will shrink 7.4 percent this year, according to the European Commission's projections. To put this figure in perspective, the 27-nation bloc's economy had been predicted to grow 1.2 percent this year. In 2009, at the back of the global financial crisis, it shrank 4.5 percent.

In its latest outlook for the world economy, the International Monetary Fund said it expects global GDP will contract 3 percent in 2020, a far worse recession than the one that followed the global financial crisis of 2008, and there is a chance of the recession extending into 2021.

It's a grim outlook, which means Bangladesh's export prospects in the near future could not be bleaker.

April's export data reveals only a part of the picture, Rubana Huq, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), told The Daily Star.

"The magnitude of the devastation is way higher. The situation is horrific."

At the time of filing this report, about 1,150 export-oriented garment factories lost orders worth about $3.18 billion, she said.

One such company that has been hit with a flurry of cancellations or request for delayed shipment is Ha-Meem Group, which counts JC Penney, Gap, Kohl's, PVH, Kontoor, Next, Abercrombie & Fitch, Garage and American Eagle as its buyers.

And almost all of them cancelled orders or asked for the existing orders to be shipped in November or December, said AK Azad, managing director of Ha-Meem Group.

More than 10 percent confirmed work orders and more than 50 percent upcoming work orders have been scrapped entirely, he said.

What's worse is some buyers are seeking unreasonable amounts of discounts. "They are offering us very low prices," Azad added.

One buyer of Desh Garments, often considered to be the architect of Bangladesh's export-oriented garment industry, asked for a 47 percent discount.

"This is impossible for any supplier," said Vidiya Amrit Khan, deputy managing director of Desh Garments, which saw order cancellations from accessible luxury brands like Kenneth Cole, Tommy Hilfiger, Calvin Klein and high-street brands like Nautica.

A good quantity of work orders was cancelled mainly by the American buyers, although the European buyers have reconfirmed their orders, she added.

"Now, the buyers are trying to work out their future business situation and giving us the assurance that they will reinstate the held and cancelled orders once they can reopen their stores," said Bakhtiar U Ahmed, chief operation officer of Fakir Apparels.

The company saw order cancellations from household high-street names like C&A, Esprit, Primark, Hummel, Marc o'Polo and s.Oliver.

In terms of value, more than $25 million orders have been cancelled or held by buyers, Ahmed said.

Zaber and Zubair Fabrics, one of the largest garment exporters, did not see any cancellations of ongoing work orders, but a lot of upcoming work orders have been forfeited, said Anol Rayhan, its brand manager.

The cancellations are from brands such as from Zara Home, Ikea and Williams-Sonoma.

"We are worried about our upcoming orders," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments