Ten life insurers hold 85pc of the market

Ten insurance companies hold around 85 per cent of the life insurance market in Bangladesh thanks to their experience and record in settling claims fast.

In the non-life insurance sector, the prevalence of top companies is common, but almost all firms hold a handsome stake in the segment.

The top 10 general insurance companies collectively control 52 per cent of the market.

In 2021, the gross premium of life insurance grew 7.63 per cent to Tk 10,255 crore compared to the previous year, according to data from the Insurance Development and Regulatory Authority (IDRA). However, the data is un-audited.

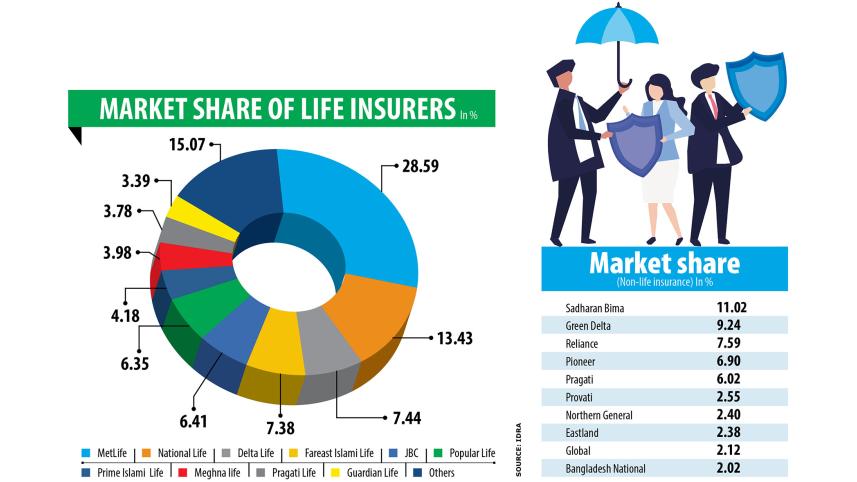

MetLife alone holds 28.59 per cent of the market followed by National Life Insurance with 13.43 per cent, and Delta Life Insurance with 7.44 per cent, IDRA data shows.

"The experience and claim settlement history of first-generation companies attracted people, so their market share is higher," said Sultan-ul-Abedin Mollah, a former member of the IDRA.

They are old and established and their network and agents are spread all over the country, he added.

People's experience with first-generation companies also makes the business easier. The policies of most of the fourth-generation insurers have not matured yet.

"As a result, it will take time for them," Mollah said.

However, Guardian Life Insurance has been exceptional. Despite being a fourth-generation company, it has been able to grab a fair share of the market riding on good corporate governance.

Guardian Life Insurance holds a 3.39 per cent market share in the life insurance sector, as per IDRA data.

Apart from Guardian Life, some of the second-generation and third-generation insurers are also doing good business due to their good behaviour.

"If other companies can create confidence among people, they will be able to win more market share as well," Mollah added.

A number of key factors contribute to an insurance company's long-term success.

They include the tenure of business, operational efficiency, the strength of the workforce, product diversification, vision, and reputation, according to Ala Ahmad, chief executive officer of MetLife Bangladesh.

At MetLife, customers' trust and confidence have helped the firm become one of the major life insurers in the market.

"Our history in Bangladesh dates back to 1952 and throughout our journey, we have focused on building one of the best teams of employees and financial associates, bringing technological innovations, and providing world-class life insurance solutions to the people of Bangladesh."

In Bangladesh, insurance penetration is less than 0.5 per cent. This indicates that life insurers can work together to bring more people under the protection of insurance.

"While healthy competition provides an incentive to excel, it is also important for companies to differentiate themselves with products and services to sustainably grow in the long run," Ahmad said.

Alamger Feroz, deputy managing director of Popular Life Insurance Company Ltd, said all 33 life insurance companies did not come to the market at the same time.

As the old ones have been doing business for many years, they have been able to grab the lion's share of the market.

"The newcomers are trying to make a mark in the market. They entered the industry when the economy was volatile. But they will also be stronger after a certain period."

SM Shakil Akhter, executive director and spokesperson of the IDRA, said some of the top companies are doing quite good business as customers have confidence in them.

"The companies' reputation has climbed to an upper level and they are getting its fruits," he said.

It is a long-term business, some of them have succeeded. But some of them are lagging behind commercially even though they were first or second-generation companies, said Akhter.

The gross premium of non-life insurance companies rose 10.5 per cent to Tk 4,137 crore in 2021.

Among the non-life insurers, state-run Sadharan Bima Corporation holds the most market share with 11.02 per cent followed by Green Delta Insurance with 9.24 per cent, Reliance Insurance with 7.59 per cent, Pioneer Insurance 6.90 per cent, and Pragati Insurance 6.02 per cent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments