Insurance stocks on upward curve

Insurance companies have been witnessing an uptrend among their shares over the last couple of months thanks to the Insurance Development and Regulatory Authority's (IDRA) move to limit commission payments to agents, according to industry analysts.

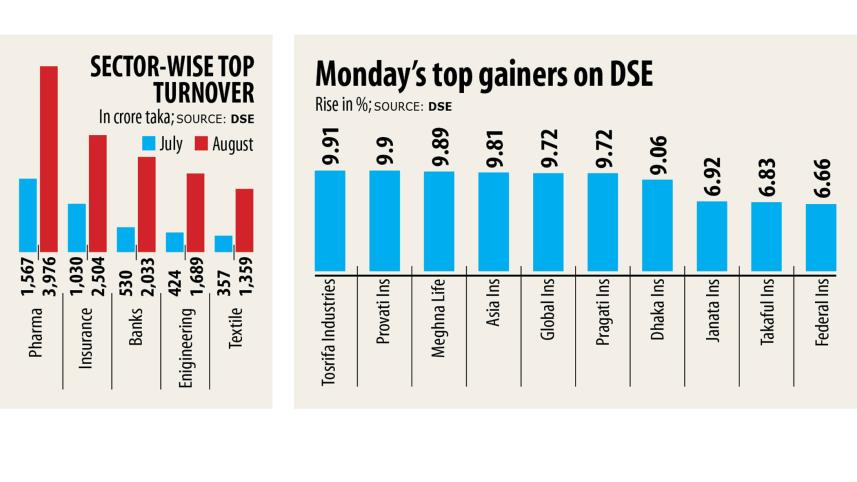

Overall turnover from insurance stocks jumped to Tk 2,504.73 crore in August, accounting for about 13.45 per cent of that month's total turnover, as per data of Dhaka Stock Exchange (DSE).

This is a 143 per cent increase compared to the previous month when it had stood at Tk 1030.39 crore.

The insurance sector came in second in the August ranking of entities with top turnovers. Pharmaceuticals took the top spot.

In 2012, the IDRA issued a circular barring insurance companies from paying more than 15 per cent of the premium as commission to their agents.

However, most insurers disregarded the directive, prompting the regulator to issue a notice in late 2019 urging compliance for the sake of the sector's well-being.

Many companies offered as high as 60 per cent of the premium as commission to secure business, which has hurt the industry, especially firms with good performance records, industry insiders said.

But in a meeting with Bangladesh Insurance Association last year, insurance companies collectively agreed to follow the order in a bid to keep the sector alive.

"Since insurance companies are now maintaining lower commission rates, it will positively impact the sector's revenue," said Khairul Bashar Abu Taher Mohammed, chief executive officer of MTB Capital.

Investors are becoming increasingly interested in insurance stocks and the trend is ongoing, he added.

As of yesterday, nine out of the top 10 gainers listed on the DSE trading board were from the insurance sector.

Of the 48 listed insurance stocks, six dropped while one remained the same and 41 advanced.

Tosrifa Industries led the list with a 9.91 per cent increase.

Fellow gainers include Provati Insurance, Meghna Life Insurance, Asia Insurance, Global Insurance, Pragati Insurance, Dhaka Insurance, Janata Insurance, Takaful Islami Insurance and Federal Insurance.

Gambling very much likely acted as the short-term catalyst behind the sector's growth as the risk-takers were attracted to the lower paid-up capital being maintained by the insurance companies, according to a brokerage's top official preferring anonymity.

"Whenever they get any news, they use it," he added.

The long-term catalysts were the regulatory reforms which attracted investors to the sector.

So, the presence of insurance stocks in the top gainers' and top turnover lists has been a common sight for the last couple of months, the official said.

Meanwhile, sponsors of some insurance companies were not holding the minimum number of shares stipulated by the Bangladesh Securities and Exchange Commission (BSEC), which also had an impact on share prices, he said.

In 2011, the stock market regulator declared that every sponsor had to hold a minimum of 2 per cent of the company's shares while a maximum of 30 per cent of the shares could be held jointly.

Many sponsors opted to neglect the order, prompting the BSEC to direct all listed companies in early July this year to ensure compliance within 45 days.

The insurance sector still lags behind in penetration so it has immense opportunities to grow, the stock broker added.

The DSEX, the benchmark index of the DSE, dropped 1.91 points, or 0.03 per cent, to 5,092 yesterday.

Turnover, another important indicator of the stock market, slumped 13.59 per cent to Tk 1,148.95 crore.

Of the total stocks, 143 advanced, 175 declined and 38 stayed unchanged, according to the DSE data.

Beximco Pharmaceuticals took first position in the DSE's top turnover list trading worth Tk 34.36 crore in shares, followed by Brac Bank, Orion Infusion and Khulna Power.

Fareast Finance shed the most, falling 9.61 per cent, while Shyampur Sugar Mills, Intech, Union Capital and Khan Brothers PP Woven Bag Industries were also among the losers.

Elsewhere, Chittagong Stock Exchange endured a 4.83-point drop, or 0.55 per cent, in the CSCX index.

Out of a total of 272 stocks listed with the port city bourse, 114 advanced, 124 fell and 34 remained the same.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments