Businesses underprepared as LDC graduation clock ticks

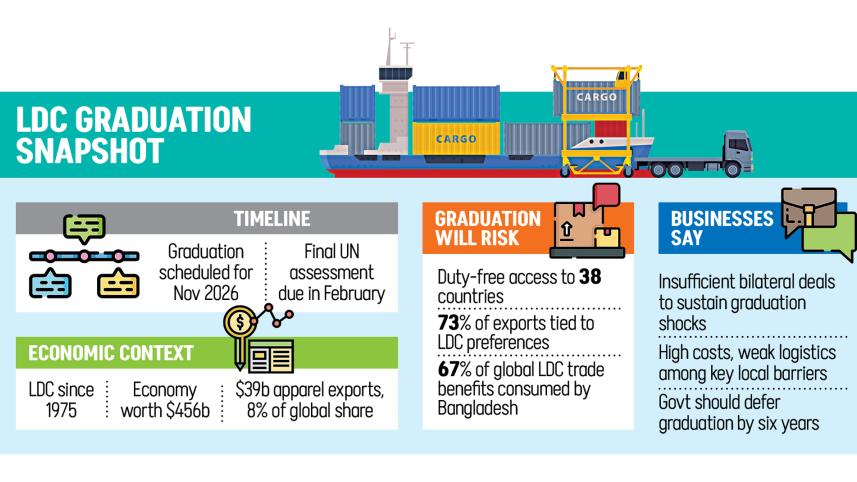

With less than eleven months left before Bangladesh exits the least developed country club, businesses say they are still not adequately prepared to face the harsher realities of a post LDC world.

At the core of their concerns is the absence of trade agreements that would allow exporters to retain preferential market access once the country formally becomes a developing nation.

Business leaders also point to weaknesses at home, from infrastructure and logistics to limited product diversification and high production costs, all of which undermine competitiveness against regional peers.

Manufacturers say if the government presses ahead with graduation without adequate preparation, they may lose at least $8 billion a year in overseas sales currently protected by preferential treatment.

The interim government has repeatedly said it will stick to the November 2026 graduation deadline. But in the face of widespread opposition, it invited a United Nations (UN) body to assess conditions on the ground.

The United Nations Committee for Development Policy (UNCDP) conducted its first assessment in November last year, gathering views from business leaders, policymakers and economists. A second round-up is scheduled for February, the same month the next national election is due.

Now business leaders say they plan to approach the next government to seek a deferment of at least six years.

AT LEAST $8B AT STAKE

Studies suggest Bangladesh could lose around 14 percent of its annual export earnings, equivalent to about $8 billion, once it leaves the LDC group and preferential access begins to fade.

At present, exporters enjoy duty-free or preferential entry to 38 countries and several trade blocs. About 73 percent of national exports benefit from these facilities.

According to trade data, Bangladesh alone accounts for 67 percent of total LDC preference utilisation among the 46 countries in the group.

Economists say these advantages have been central to export growth over the past decades. Since joining the LDC category in 1975, Bangladesh has used preferential access to build a strong export base, especially in garments.

Last year, apparel exports reached $39 billion, making Bangladesh the second-largest garment exporter after China with close to 8 percent of the global market. Meanwhile, the country's economy has grown into a $456 billion market.

The risk, according to economists, is concentration. Unlike many countries that have graduated, Bangladesh is heavily reliant on a single export sector and a limited number of markets, leaving it more exposed to any sudden loss of trade privileges.

FEW TRADE DEALS SO FAR

To manage the graduation shock, the government last year adopted a Smooth Transition Strategy (STS). The strategy envisaged signing trade agreements with major partners to preserve market access after graduation.

But the progress has been slow so far.

Till January this year, Bangladesh has signed just one preferential trade agreement (FTA) with Bhutan, effective since 2022.

Negotiations with Japan on an Economic Partnership Agreement (EPA) were completed in December last year. Commerce Adviser Sk Bashir Uddin said the deal with the island nation is expected to take effect by the end of January.

Talks with other key partners and blocs, including the European Union (EU), South Korea, the United Arab Emirates, Indonesia, RCEP and Asean, continue with no clear timelines.

At home, businesses say conditions have worsened rather than improved. Bureaucratic delays, policy uncertainty and infrastructure bottlenecks continue to push up overhead costs and weaken competitiveness.

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said the government does not have a clear roadmap for graduation.

"The interim government did not sit with businessmen and did not prepare any concrete plan for the post-LDC period," he said.

HOME FRONT WEAK TOO

Last year, leaders of 16 major trade bodies and chambers wrote to Chief Adviser Professor Muhammad Yunus, urging the interim government to seek a deferment of at least six years.

They cited a long list of pressures, including high interest rates, stress in the financial sector, gas shortages, rising energy prices, limited industrial land and inadequate workforce skills.

Business leaders argue that pressing ahead without proper groundwork would be a costly error.

"The decision on LDC graduation should not be whimsical. It must be based on detailed studies," said Anwar-ul Alam Chowdhury (Parvez), president of the Bangladesh Chamber of Industries (BCI) and a former BGMEA president.

Showkat Aziz Russell, president of the Bangladesh Textile Mills Association (BTMA), said primary textile producers are already struggling under higher production costs. "Gas prices were raised locally although international prices fell, which hit production hard," he said.

He added that recent improvements in foreign exchange reserves and remittance inflows do not yet point to economic stability. "Graduating in such a situation would not reflect wisdom," he said.

Some economists echo these concerns.

Mohammad Abdur Razzaque, chairman of local think tank Research and Policy Integration for Development (RAPID), said the level of overall preparation is inadequate given the limited time left.

"Bangladesh must identify a small number of top priorities that can realistically be addressed within the next six months," said the economist.

Those priorities, according to him, include reducing the cost of doing business, improving law and order, streamlining customs procedures and stepping up engagement with the European Union to secure GSP Plus status after graduation.

Razzaque said that while deferment remains an option, the looming election and political transition make decisions more complex.

Even so, he said graduation could still serve as a policy anchor if used to accelerate long delayed reforms.

Anisuzzaman Chowdhury, special assistant to the chief adviser of the interim government, said progress should be viewed in relative terms, as there is no single benchmark.

He said the government has identified 12 priority export sectors beyond garments and is working to improve compliance and the broader business environment.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments